Started From a Kitchen Table

Back in 2019, I was helping a friend restructure his manufacturing budget. We spent three nights at his kitchen table, drinking terrible coffee and arguing about vendor contracts. That's when I realized something—most businesses don't fail because of bad products. They fail because money conversations are awkward, rushed, or avoided completely.

Why Budget Talks Matter

Look, I've been in rooms where people spend hours discussing office furniture but fifteen minutes on quarterly budgets. The discomfort around money negotiations isn't just cultural—it's universal.

Vietnam's business landscape has this interesting dynamic. Relationships matter more than anywhere I've worked before. But that same emphasis on harmony sometimes means critical budget discussions get postponed until they become emergencies.

We've helped 47 companies since 2020. Some were startups burning through capital too fast. Others were established manufacturers discovering their profit margins had disappeared somewhere between 2022 and 2024.

What Drives Our Work

Three things we care about more than anything else when sitting across from clients.

Honest Conversations

No consultant speak. No buzzwords. If your budget proposal doesn't make sense, we'll tell you—and explain why in plain terms you can actually use.

Real Context

Numbers alone don't tell the story. We dig into what's actually happening in your operations—the stuff that doesn't show up in spreadsheets but affects everything.

Long-Term Thinking

Quick fixes create bigger problems later. We focus on building negotiation frameworks that work for years, not just the next quarterly review.

The People Behind the Work

Two people who've spent way too much time thinking about budget negotiations. We've made plenty of mistakes, learned from most of them, and occasionally still argue about the right approach to vendor contracts.

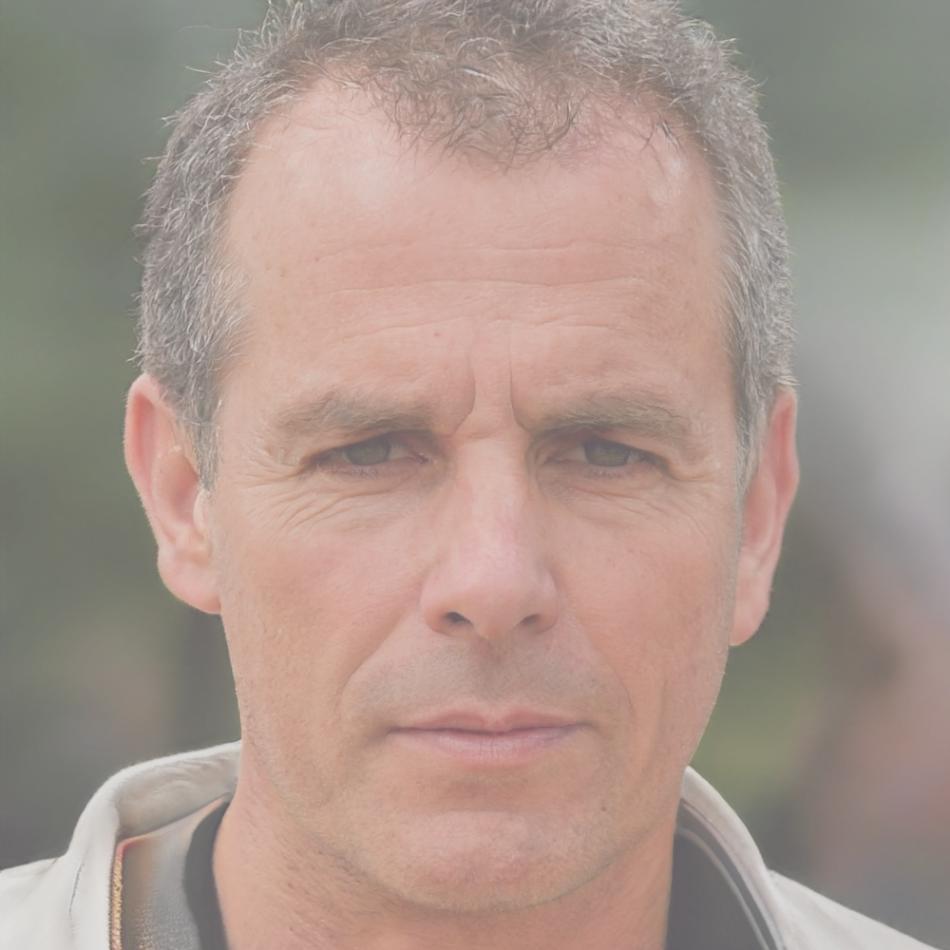

Calvin Morse

Lead Budget Strategist

Spent eight years in corporate procurement before realizing I was better at teaching negotiation than doing it myself. Still drinks terrible coffee.

Reese Chandler

Financial Operations Director

Former CFO who got tired of watching good businesses make preventable budget mistakes. Now helps others avoid the same problems I used to create.

How We Actually Work

No complicated methodologies here. Just a straightforward process we've refined through dozens of real client situations.

Listen First

We spend the first session just listening. What's working? What isn't? Where do budget discussions typically break down? Most insights come from what clients tell us in the first hour.

Map the Reality

We dig into your actual spending patterns, not just the official budget. Where does money really go? Which departments consistently exceed projections? What unexpected costs appeared last year?

Build Your Approach

Together, we create a negotiation framework that fits your specific situation—not some generic template. This includes conversation scripts, data presentation methods, and backup strategies for different scenarios.